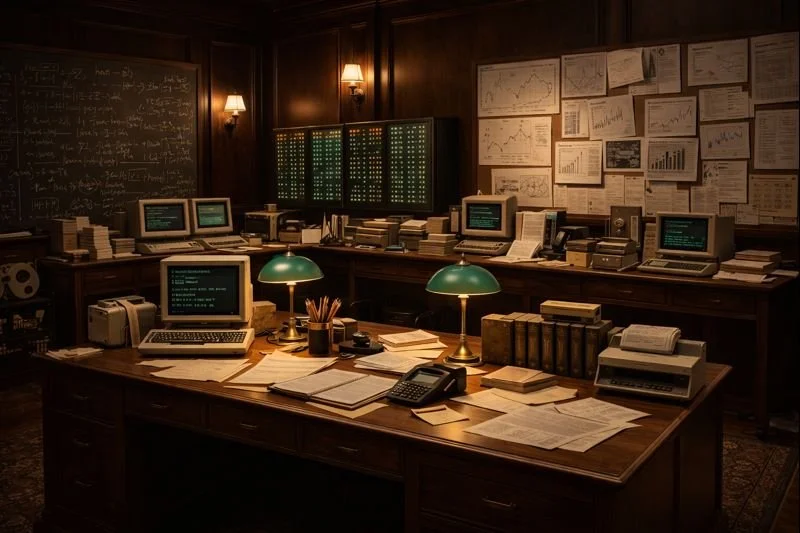

The Quant Room

By the mid - 1980s, markets began to change in a fundamental way. Trading floors were still loud, but behind them something quieter was taking shape. Computers arrived at the desk. Spreadsheets replaced notebooks. Risk was no longer felt - it was measured.

This was the beginning of the quantitative era

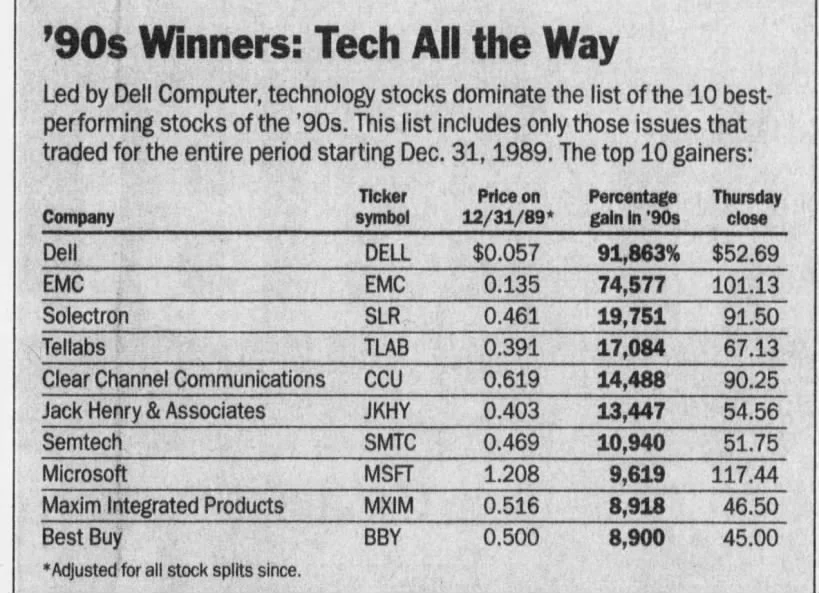

1990 - When computing became normal

By 1990, computers were no longer experimental tools in finance - they were becoming standard equipment. Spreadsheets replaced ledgers. Data could be stored, replayed, and analysed at a scale. Trading was still largely human, but decisions were increasingly supported by models. Risk was measured statistically, not instinctively. The idea the markets could be understood through numbers had quietly taken hold.

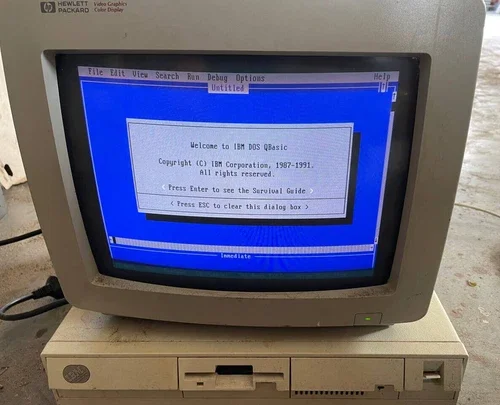

Workstation c. 1990 - 1995

By the early 1990s, computers like these had moved from experimental to standard equipment on trading desks. Spreadsheets replaced ledgers. Risk could be modelled, replayed, and stress tested. This was not automation - it was the quiet discipline of numbers entering decision making.

Original 1990s workstation - available

New York stock exchange poster, 1990s

Even as computing became normal, the symbolism of markets remained human .This poster hung above desks where screens multiplied, but traditions stayed fixed.

Original NYSE- era wall poster - available